Some customers are becoming suspicious of loyalty apps.

A columnist for the Washington Post wrote in October about his realization that the Starbucks app was showing him fewer promotions during the months when he bought more coffee. That anecdote then appeared in a Reader’s Digest article about surveillance pricing within loyalty apps for a host of industries, from airlines to retailers.

So, are companies avoiding giving customers deals, or even presenting them with more expensive prices, if they’re members of a loyalty program?

To loyalty consultant Don Smith and loyalty expert Mladen Vladic, the answer is a resounding “no.” Treating loyal customers worse than others is not a practice either would recommend. But when it comes to using loyalty data, the answer is more nuanced.

“I see rewards and loyalty as a tool to help [companies] with their overall business objectives,” said Vladic, who is the head of product, payment networks at fintech firm FIS. “But you have to strike the right balance.”

A balancing act

Connected to surveillance pricing is the concept of personalization, which, in itself, requires a balance. Too much can be overwhelming or creepy. Done right, it can make a customer more likely to pay a premium, increase their basket size or boost satisfaction.

Personalized pricing can, perhaps, more easily slip into the negative side of the spectrum. There could be a case in which two customers sitting next to each other, with equal loyalty status, could be charged different amounts for the same product. Smith, who is the global consulting officer and CMO at customer loyalty consultancy Brierley, a Capillary Services company, would go past “surveillance” and call that “predatory pricing.” And it’s a quick way to break trust.

“If [customers] sensed that was happening in a loyalty app, or that loyalty data were being consumed for that purpose, they would opt out of loyalty,” Smith said.

Using personalization data to determine prices could cross an ethical line, Smith continued. Historically, predatory pricing tactics contain racial and gender biases, especially for luxury goods for which the price is negotiable.

Pricing fluctuations based on market factors, though, is more ethical. The pricing impact of lower inventory and higher demand is basic economics.

On the other side of the balancing act is the fact that CX teams use loyalty platforms to acquire, attract, activate, encourage engagement and drive retention within a given budget, as Vladic put it. The budget for promotions is not unlimited, nor is it necessarily the same each month or each quarter. If a company determines it will get a better return on investment by giving more promotions to a new loyalty member than a frequent user of the loyalty app, there’s a business case for doing so.

Still, Vladic continued, there’s risk involved. Though he declined to comment on the Starbucks case, he noted that bad press or negative Reddit threads could impact brand reputation and, ultimately, loyalty. Customers these days aren’t opposed to shopping around.

“The ability to switch is easier than ever before,” he said.

A ‘sea of sameness’

To customers, whether their loyalty data is being used to give them more or fewer promotions, cheaper or more expensive prices, may not matter. Vladic estimated most don’t spend any significant amount of time analyzing such fluctuations. It’s less about what they aren’t getting, and more about what they are getting.

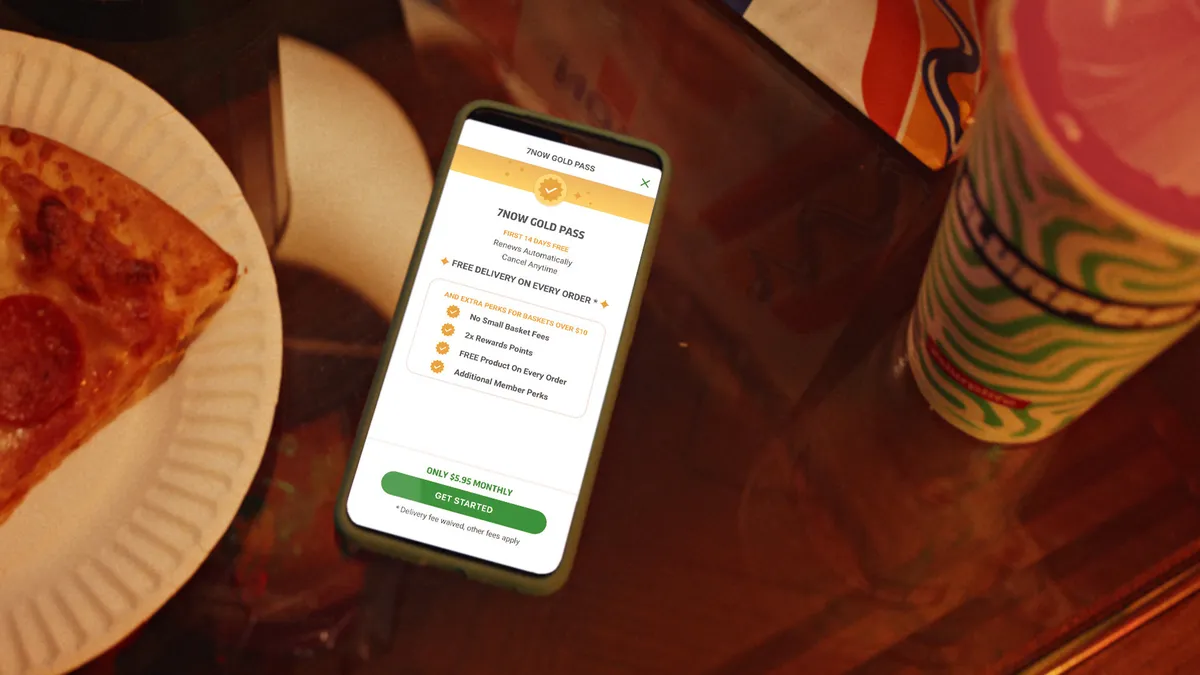

Customers have come to expect certain perks from all loyalty memberships. Most will offer holiday deals, double points and limited time offers, Vladic said. But these ubiquitous expectations also lead to what Vladic called the “sea of sameness.” The ability for a loyalty program to stand out is a challenge that is, perhaps, more noticeable to customers.

“Unless you're going to bring something that is differentiated from competition, however you define that to be or however you define your competition, don't do it, because you're not going to get the incremental lift that you are looking to get,” Vladic said.

The basics matter, too. Smith urges program managers to track loyalty members’ purchases and reinvest a portion of that to provide perks and experiences. Transparency around standards for ethical data collection and usage is becoming a requirement, as more companies are publishing that type of information for customers to access.

In short, Smith had this advice: “Don't take your loyal customers for granted.”