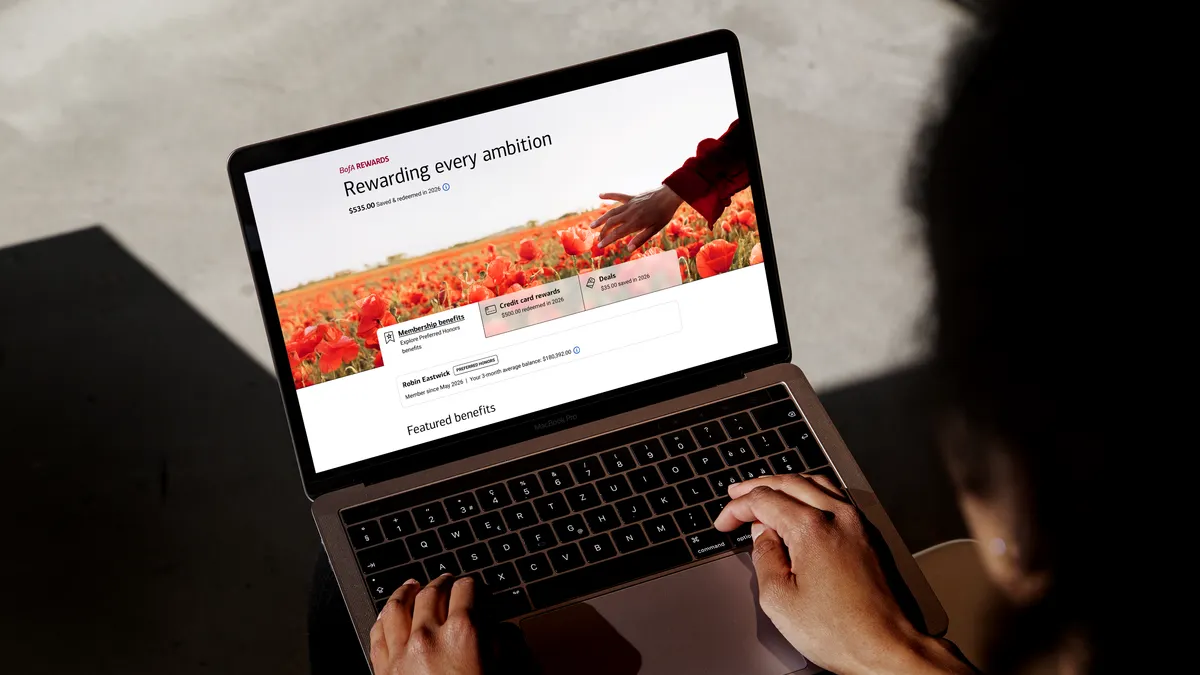

Bank of America is rolling out a no-fee rewards program that expands its reach among its customers, the bank said Wednesday. BofA Rewards will replace Preferred Rewards on May 27, executives told reporters during a media briefing Tuesday.

In the existing rewards program, clients need to have $20,000 in their account to enroll. With the new program, customers only need an eligible account with Bank of America to enroll in the program, allowing for 30 million more clients to join. Eligible accounts include deposit accounts, Merrill investment accounts, 529 plans and revocable grantor trust accounts.

“BofA Rewards is going to move us into the next era of loyalty, building on that success, but evolving it to be more modern and aligned with our changing client needs,” said Mary Hines Drosesch, head of consumer and small business products and analytics. “It'll be accessible, experiential, personalized and tangible.”

The rewards program will still maintain tiers based on three-month average account balance with corresponding rewards:

- Clients with under $30,000 are considered members.

- Clients with $30,000 to $100,000 are in the preferred plus tier.

- Clients with $100,000 to $1 million are in the preferred honors tier.

- Clients with more than $1 million are considered premier members.

Bank of America’s existing Preferred rewards program has been successful, with 11 million members and 99% retention. But the bank wanted to modernize the program and expand its reach. The changes made in BofA Rewards are expected to double membership within the next few years.

Including everyone as a member of the program is a best practice, according to Brad Jashinsky, director analyst at Gartner. Some members, for example, may not have the financial means to access big perks at the moment, but may in the future.

“The new rewards program provides members with only a checking account a bigger incentive to add additional Bank of America products and services,” Jashinsky said in an email. “Enrolling everyone into the program helps familiarize all of their customers with the program, even if they are not quite ready to move up into other tiers.”

All members receive perks. Those in the lowest tier receive a 10% bonus on eligible cards, fraud and identity monitoring, as well as minor auto and home loan discounts. As customers go up the tiers, the bonus for credit cards and auto and home loan discounts increase.

The preferred honors and premier tiers also gain access to lifestyle benefits and subscription credits.

“What we want to make sure as part of this program is we're providing them with a good balance of financial as well as experiential value and rewarding them with benefits that span across their entire lifestyle based on where they are in their lives,” Shikha Narula, head of consumer deposit products and rewards at Bank of America, told CX Dive. “There will be differentiation in what they have access to at the $100,000 level, which will include offerings from premium brands such as BMW and Audi.”

The highest tier will have access to many more personalized experiences, such as Michelin star dining experiences or chauffeur services.

“An increasing number of consumers prefer experiential benefits in loyalty programs,” Jashinsky said.

Garner found a 17% increase in consumers selecting at least one experiential loyalty benefit from 2018 to 2024. Gen Z consumers also overindex on preferring experiential rewards. Experiential rewards also help brands differentiate their programs and are less costly than cashback rewards.

“Providing cashback rewards has a direct cost and consumers can easily compare 1% vs. 2% cashback rewards,” Jashinsky said. “The costs to provide experiential rewards can be more affordable for brands and make the brand more memorable to consumers.”

The rewards program differentiates itself from the field for being a relationship-based loyalty program, according to Hines Droesch.

“We want to reward our clients for every aspect of their relationship with us, not just one part of it,” Hines Droesch told CX Dive. “So when you look at the banking industry, there is no other relationship based loyalty program. There might be a program for their deposit clients or a program for their credit card clients. This really brings together all the products and services that we offer to our clients into one holistic program, and what that results is we never give our clients a reason to go elsewhere.”

While current members of Bank of America’s existing program will be automatically placed in the new program and corresponding tier, those newly eligible can navigate to the “BofA Rewards” section of the Bank of America Online Banking or Mobile Banking app to enroll.