In an effort to overcome the increasing limitations of customer surveys, a growing number of businesses are using AI-powered digital twins of their customers to understand, predict and influence their behavior.

“It is essentially synthetic customer modeling,” said Vijay Pandiarajan, lecturer of technology and operations at the University of Michigan’s Ross School of Business.

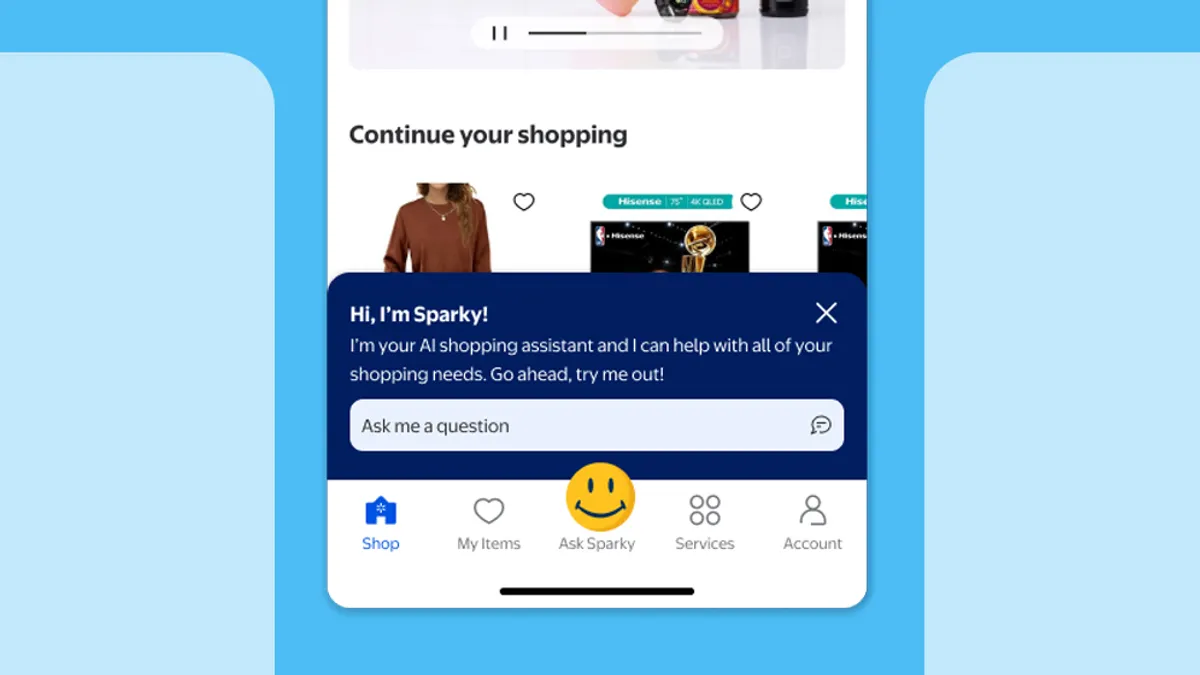

These dynamic, virtual representations mimic, analyze and predict customer behaviors, using first-party data and other consumer data sources to replicate customer experiences in a digital environment. They can be applied to customers, customer segments, customer personas and machine customers, including virtual assistants like Amazon’s Alexa.

There is a wide range of use cases for digital twins of the customer, including customer journey simulation, customer sentiment analysis via virtual focus groups, cross-channel optimization, risk forecasting and sales training.

Brands may conduct A/B testing to observe and predict customer responses to price changes in real time, identify pain points in the online shopping cart experience, anticipate how customers will respond to feature changes or predict customer churn.

Telecom companies, for instance, may use digital twins to determine which customers are most likely to “jump ship” by analyzing usage patterns, social media posts, complaints and payment behavior, Pandiarajan said.

In addition, simulating customer journeys will become even more critical as agentic AI erodes “discrete touchpoints,” said Lizzy Foo Kune, distinguished VP analyst and co-leader of the Gartner Futures Lab.

Mileage may vary

While using digital twins can be more efficient than traditional customer research methods, many organizations are overly focused on cost and time savings.

"Not all digital twin approaches are quick, easy and cheap,” said Eda Cetinok, SVP and chief client success officer for Ipsos CX. “That’s a misconception.”

Brands need to be thoughtful about what they’re trying to achieve and which methods are best suited to their objectives, with more complex objectives requiring more complicated and expensive solutions.

Some industries and businesses are particularly well-suited to using digital twins to understand their customers better. For instance, hospitality, retail, travel and business-to-business organizations are often a good fit for digital twins because they have rich customer data.

Financial services, on the other hand, may find it more challenging to implement digital twins of the customer because privacy regulations complicate data integration.

Companies may also face pushback from customers, policymakers and other stakeholders over privacy concerns and the potential for misuse, concerns that “are fair and valid,” Foo Kune said.

No silver bullet

The successful implementation of digital twins of customers is similar to other AI technologies, requiring organizations to define use cases, identify key performance indicators, act in consumers’ best interests and establish trust.

“Some organizations want to think like they can cut corners through AI, but that's not reality,” Cetinok said.

Digital twins also require organizations to establish a robust AI governance framework, adopt sound data management practices and integrate their tech stacks, including customer relationship management software and customer data platforms.

If those things are not in place, digital twins can cause more harm than good. If the underlying data is low quality, for instance, twinning it can make things worse by increasing the “impact of the bad originating data,” Cetinok said.

According to experts, businesses interested in adopting digital twins of the customer must focus on four key components including:

- Entity meta data, such as account numbers;

- Generated data, such as usage, customer journey stage or purchase history;

- Analytical models that use algorithms to take in generated data and model the next best action, likelihood to churn or rules around which messages to show and in what order;

- Software components, such as application logic, visualization tools and other functionality that help CX professionals act on information based on the analytical models, such as generating a support ticket based on an identified customer issue.

Given the complexity of successfully implementing the technology, businesses should adopt it cautiously and build confidence in the models over time.

“You need to crawl, walk, run,” Pandiarajan said. “You really don’t want to abandon surveys or focus groups and adopt digital twins overnight.”

Focusing on customer segments rather than individual customers can also help organizations use their resources more efficiently, as creating twins of individual customers can be prohibitively expensive.

"It’s a very dangerous approach. Some companies are so fixated on hyper-customization that they have a million customers and a million specific digital twins,” Pandiarajan said. “It's not a wise use of their budget.”

Regardless of the approach, businesses interested in using digital twins need to understand that while “AI might give us additional paths to getting to good,” there are no short cuts, Cetinok said. “There is no silver bullet, and there never has been.”