Prices are on the rise due to inflation and tariffs, and it’s taking a heavy toll on customer loyalty.

Consumers are looking for ways to stretch their dollars, and the right loyalty program can meet their financial needs while building strong relationships to keep customers from straying. These demands are giving rise to points-based loyalty, which is only expected to grow in 2026.

Customers will differ on whether they care about special experiences, unique offers, or social elements in a loyalty program — but no one will ever say they hate earning points toward discounts or freebies, according to Halle Stern, principal analyst at Gartner.

Consumers are “very price focused versus experience or relationship focused,” Stern told CX Dive. “Obviously, there are other elements that play into it, but I think that points are very crucial right now given the economy and given how expensive everything’s getting.”

Points-based programs are already proliferating through launches and revamps this year at companies like Jimmy John’s and Lowe’s. Experts expect the momentum to grow in the coming year as brands work to keep up with customer demands for flexibility and personalization.

Major attractions of points-based programs include flexibility for customers to choose how and when they redeem rewards, the ability to gamify points to keep shoppers engaged, and the hyperpersonalization of rewards for each loyalty member via AI.

Flexibility will be a loyalty must

It’s not just that customers want discounts from loyalty programs; they want those discounts at the time and place of their choosing.

Legacy loyalty programs tend to be aspirational, according to Len Covello, CTO at technology loyalty program solutions provider Engage People. Customers would save up over long periods for large discounts or special prizes, rather than take the program into consideration on every trip.

Shifting consumer trends have changed that. Younger consumers in particular are used to immediate discounts from programs like Starbucks Rewards, where rewards start as small as an extra espresso shot in your drink.

“The ability to redeem in a micro transaction world has become the norm,” Covello told CX Dive.

However, smaller rewards aren’t the only options consumers are looking for. In a December survey by The Wise Marketer commissioned by Engage People, nearly all respondents said it’s important to have control over when and where they redeem their rewards points with retailers.

Modern customers are divided between redeemers who are thrilled to earn small but regular discounts, and savers who want to save up for something big even if it takes them several years, according to Covello. A strong loyalty program will have options that appeal to both crowds.

“Choice is huge because one size doesn't fit all,” Covello said.

Gamification will keep customers engaged

Customers may be focused on savings, but that doesn’t mean they don’t appreciate the experiential side of loyalty.

Gartner is seeing more companies gamify their loyalty programs in addition to the introduction of points-based rewards, according to Stern. The combination is natural — it’s very easy to incentivize earning points in ways that feel fun and compelling beyond just swiping a card.

“We're seeing more of around the experiential earning of points,” Stern said. “So you share information about a brand on social media, you participate in an event, or you check in at a location, and you get points towards your next purchase.”

Gamification will grow in importance as points-based programs become the baseline, Covello predicts. When a customer is collecting points from every brand they frequent, the flexibility of points alone is not enough to make any given loyalty program stand out.

“At the end of the day, it's table stakes,” Covello said. “Everyone's going to earn something. The earn rates are going to be relatively similar. If you sit back and you do the math on a blank sheet of paper you'll figure out how they fund the earn, and it's fairly similar across a lot of programs.”

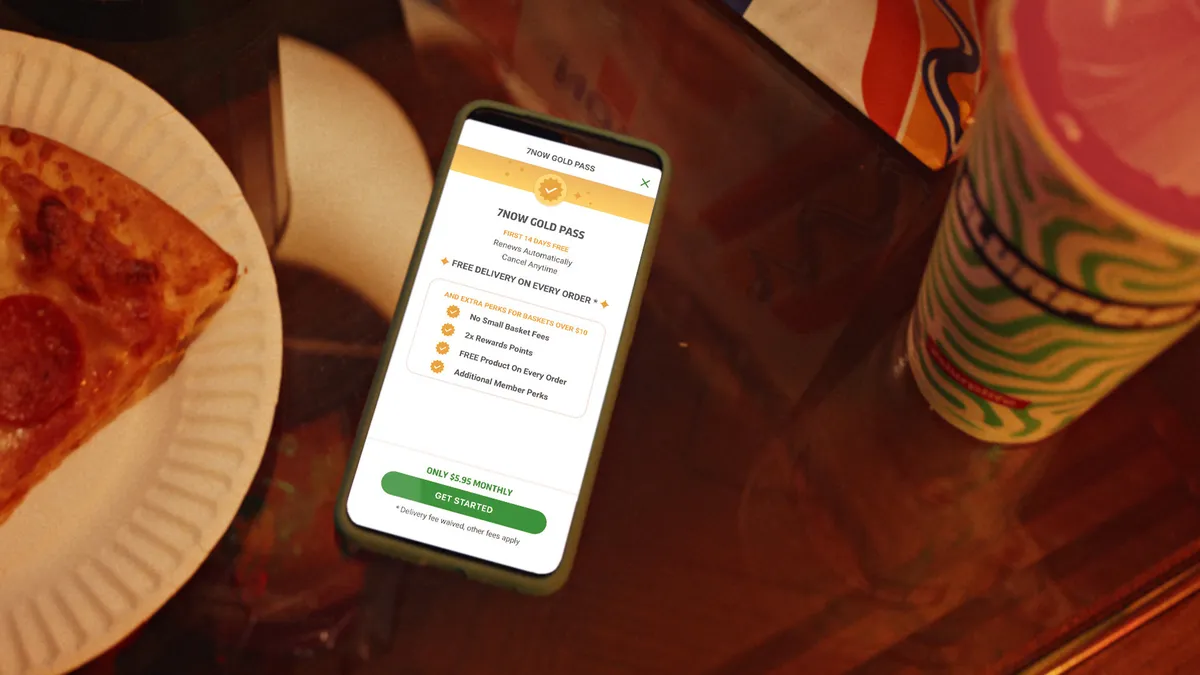

Other perks that complement points and build engagement with a loyalty program could gain greater prominence in 2026 as well.

Benefits like free shipping or the ability to pay with points at a gas pump encourage customers to use that brand again and again, Covello said. These perks, like points, are becoming an integral part of a loyalty program that keeps customers coming back.

AI will enable hyperpersonalization

AI is shaking up the CX practice as a whole, and loyalty is no different. The technology is poised to change how programs approach personalization in particular.

The biggest impact will likely be the introduction of individualized loyalty program experiences, according to Stern. AI and predictive analytics can dig into a customer’s behavior and purchase history to tailor reward options and offers that meet their specific needs.

“AI and predictive analytics are creating very, very hyperpersonalized experiences in a loyalty program where multiple people could be members of the same program and have very different journeys,” Stern said.

As AI starts to play a larger role in loyalty during the coming year, leaders will need to take special care with how they roll it out, according to Covello. Brands need to be sensitive about how customers see their interactions, especially when it comes to AI-personalized messaging and imagery.

“You still need a gatekeeper to watch, as brands still need to be protective of what's ultimately being generated,” Covello said.